Choosing the Right Investment Account: A Guide for Investors

Choosing the Best Investment Account for Your Future Orooj Financial can help you maximize your savings and grow your wealth.

Customized estate planning, life insurance, and tax-efficient strategies for business owners, professionals, and families in the GTA.

We are committed to delivering clear, reliable financial guidance built on a foundation of education, deep knowledge, and proven experience backed by a dedicated team ready to serve you.

No matter where you are in life, we’re here to help you feel financially confident. Explore our range of tailored financial products and services designed to meet your unique goals.

Managing your finances can be simple. Save this page as your go-to hub for essential financial tools, calculators, and valuable resources.

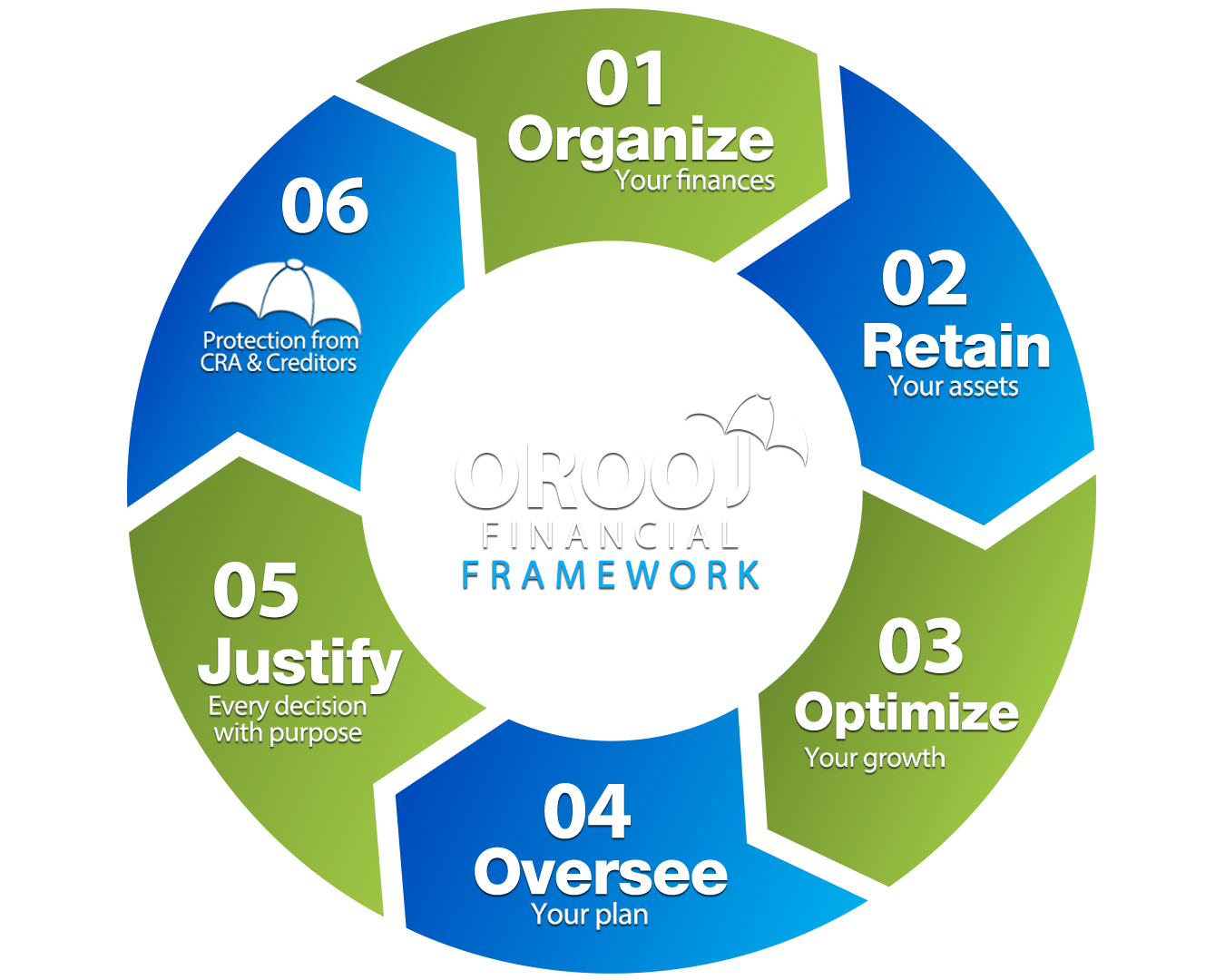

Protection from CRA and Creditors – Safeguard your finances through careful planning and legal structures.

Protection from CRA and Creditors – Safeguard your finances through careful planning and legal structures.

Choosing the Best Investment Account for Your Future Orooj Financial can help you maximize your savings and grow your wealth.

Wondering how soon you can withdraw cash value from life insurance? Learn the timelines, options, and smart tips to access your funds quickly and safely.

What happens when a business partner dies? Without a solid buy-sell agreement, it can lead to financial chaos. Learn how to protect your business now!

EXCELLENTTrustindex verifies that the original source of the review is Google. I had a great experience working with Zahid Syed. He was incredibly knowledgeable, patient, and professional throughout the entire process. He took the time to understand my needs and made sure I was financially protected, especially when it came to critical illness coverage. Zahid explained everything clearly, answered all my questions, and made the whole experience smooth and stress-free. I truly appreciate his dedication and the care he shows for his clients. Highly recommend him to anyone looking for trustworthy financial protection and guidance!Posted onTrustindex verifies that the original source of the review is Google. Prompt servicePosted onTrustindex verifies that the original source of the review is Google. I worked with Zahid and he helped me get my first policy! I wanted to diversify and increase savings, the policy he set me up with was a perfect fit. Rehan from Orooj Group was very helpful as well he got on calls with me whenever needed and walked me through the process step by step. Would highly recommend working with them, really professional and swift with getting things done. 10/10 servicePosted onTrustindex verifies that the original source of the review is Google. Excellent service and communication and I recommend to everyone for insurance needs thank youPosted onTrustindex verifies that the original source of the review is Google. Review for Rehan Ali Syed – Life Insurance Advisor I had the pleasure of working with Rehan Ali Syed for my life insurance and overall financial planning, and I couldn't be more satisfied with the experience. From our very first meeting, Rehan demonstrated exceptional knowledge, professionalism, and genuine care for my long-term financial well-being. He took the time to thoroughly understand my goals and concerns, and helped me build a solid plan that not only protects my family but also supports my broader financial objectives. Rehan explained complex insurance and financial concepts in a way that was easy to understand, and his recommendations were always thoughtful, strategic, and tailored to my specific needs. What truly stood out was his patience and commitment. He never rushed the process and was always available to answer questions and provide guidance, no matter how big or small. Thanks to Rehan’s advice, I now have peace of mind knowing that my financial future is secure and well structured. I highly recommend Rehan Ali Syed to anyone looking for a trustworthy and knowledgeable advisor who truly puts his clients first.Posted onTrustindex verifies that the original source of the review is Google. Rehan is very knowledgeable and has the patience to explain everything very well - With Rehan you are in good hands ! Highly recommendedPosted onTrustindex verifies that the original source of the review is Google. I am extremely impressed with Zahid Syed, whose professionalism and expertise in financial planning are truly exceptional. He takes the time to thoroughly assess goals, carefully addressing all the concerns and questions while designing a customized financial plan. In addition to his deep knowledge, Zahid is highly resourceful, always providing insightful solutions and guidance. His positive energy and passion for his work shine through, making the entire experience both seamless and reassuring.Posted onTrustindex verifies that the original source of the review is Google. Great experience with Orooj Financial Group. Their team is knowledgeable, responsive, and focused on helping clients achieve their financial goals. Definitely worth working with! They have gone above and beyond to help me get my finances back on track and I’m very grateful for this! Will continue working with them for a long time!Posted onTrustindex verifies that the original source of the review is Google. I had the pleasure of working with Zahid Syed of Orooj Financial Group, and I couldn’t be more impressed with their services. From the moment I reached out, their team was responsive, professional, and genuinely focused on understanding my financial goals. They took the time to explain complex financial concepts in a way that made sense, and I never felt rushed or pressured. Their advice has been invaluable, and I feel much more confident about my financial future. Whether it’s investments, budgeting, insurance and financial planning, they offer tailored solutions that meet your unique needs. I highly recommend Orooj Financial Group to anyone looking for expert guidance and exceptional service!Posted onTrustindex verifies that the original source of the review is Google. Its has been great working with the team. They are helping us reorganize our finances and it has been a great eye opener.Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Begin your financial journey by scheduling your appointment

navigate the complexities of estate planning with ease. Our toolkit provides everything you need to create a solid estate plan tailored to your unique needs.